Weak dollar policy?

- Gustavo A Cano, CFA, FRM

- Jul 26, 2024

- 1 min read

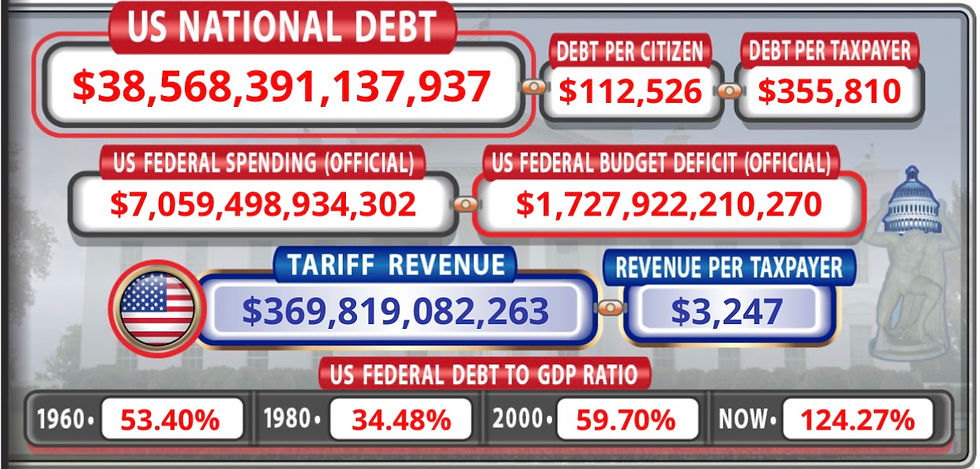

One of key messages from the republicans party nominee, has been the weak dollar policy to boost manufacturing in the U.S. it’s another version of onshoring to, in theory, decrease the Trade deficit and boost employment within the medium and low incomes. There are several ironies to discuss: (1) the dollar has already weakened against gold, which trades at all time highs, but it remains muted against other major currencies. (2) weak dollar policy is inconsistent with tariffs, which is another tool to be used against China, one of the biggest trade partners for the U.S., since it’s inflationary and will prevent official interest rates from going down. (3) Other countries can play that game too, and they will, so it becomes a race to the bottom that will create inflation and will not improve competitiveness.

Want to know more? join Fund@mental here https://apps.apple.com/us/app/fund-mental/id1495036084

#iamfundamental #soyfundamental #wealthmanagement #familyoffice #financialadvisor #financialplanning

Comments