US treasury debt issuance

- Gustavo A Cano, CFA, FRM

- Jun 30, 2023

- 1 min read

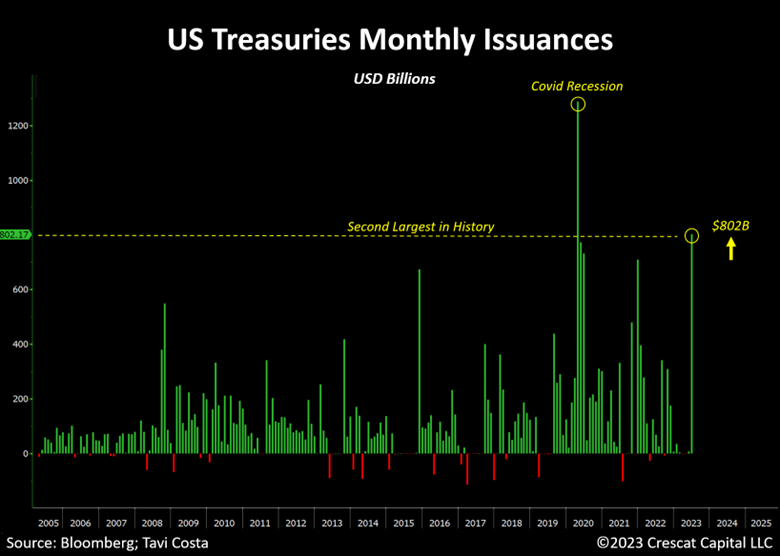

The US treasury has issued the second biggest amount of US treasury debt ever. After Covid stimuli, which was the biggest in history, the issuance to replenish the Treasury General Account after the #debtceiling negotiation has reached $802Bn. As a consequence, 2 year bond yield has surpassed 4.92%, up from 4.4% at the beggining of the month. On top of that, the fed keeps using speeches and narrative to communicate they’re not done with #ratehikes, and that 2 more hikes might happen in July and September. The market, however, keeps thinking, and betting, that rates will fall down starting in September and that they will do it, somehow, rapidly. The disconnect between markets and regulators contine and the problem is being amplified by debt.

Want to know more? join Fund@mental here https://apps.apple.com/us/app/fund-mental/id1495036084

#iamfundamental #soyfundamental #wealthmanagement #familyoffice #financialadvisor #financialplanning

Chart Source: crescat capital

Comments