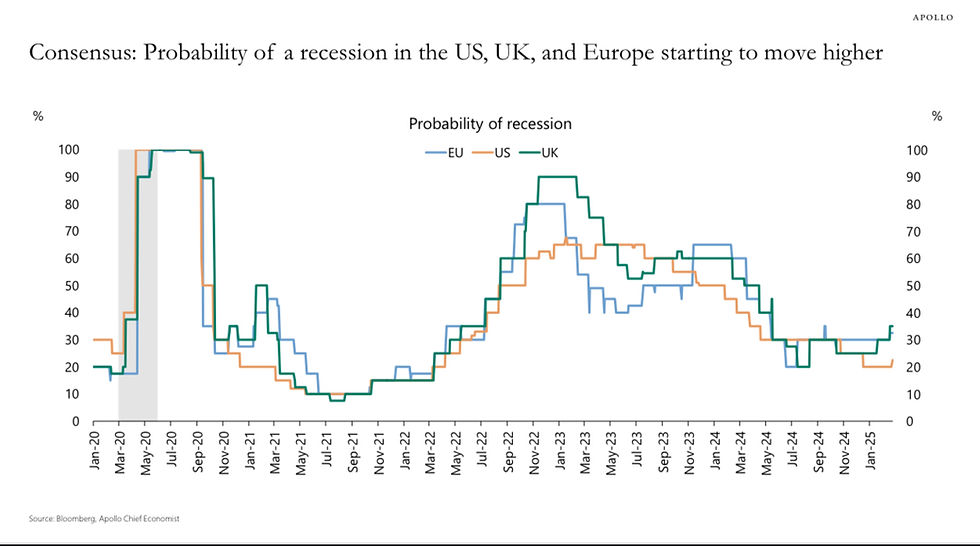

The Federal Reserve preferred inflation measure, PCE, was published yesterday with a YoY increase of 2.5%, which is comfortable enough to keep claiming victory on the price stability mandate. Despite that fact, probabilities for rate cuts remain muted as of today with 92% probability of no action for the March meeting. But what’s is starting to increase, is the probability of recession, as you can see in the chart below. We have to bear in mind that even though the odds are still low, they typically increase very rapidly as the situation deteriorates. Often, the probability of recession spikes vertically in a matter of months. As liquidity in the system is reduced, and indicators such as consumer spending showed a contraction in January (-0.2%), one starts to wonder is there are cracks in the system, that are simply covered by the liquidity high tides.

Want to know more? join Fund@mental here https://www.myfundamental.net

#iamfundamental #soyfundamental #wealthmanagement #familyoffice #financialadvisor #financialplanning

Comments