Inflation is getting back to normal

- Gustavo A Cano, CFA, FRM

- Jun 13, 2023

- 1 min read

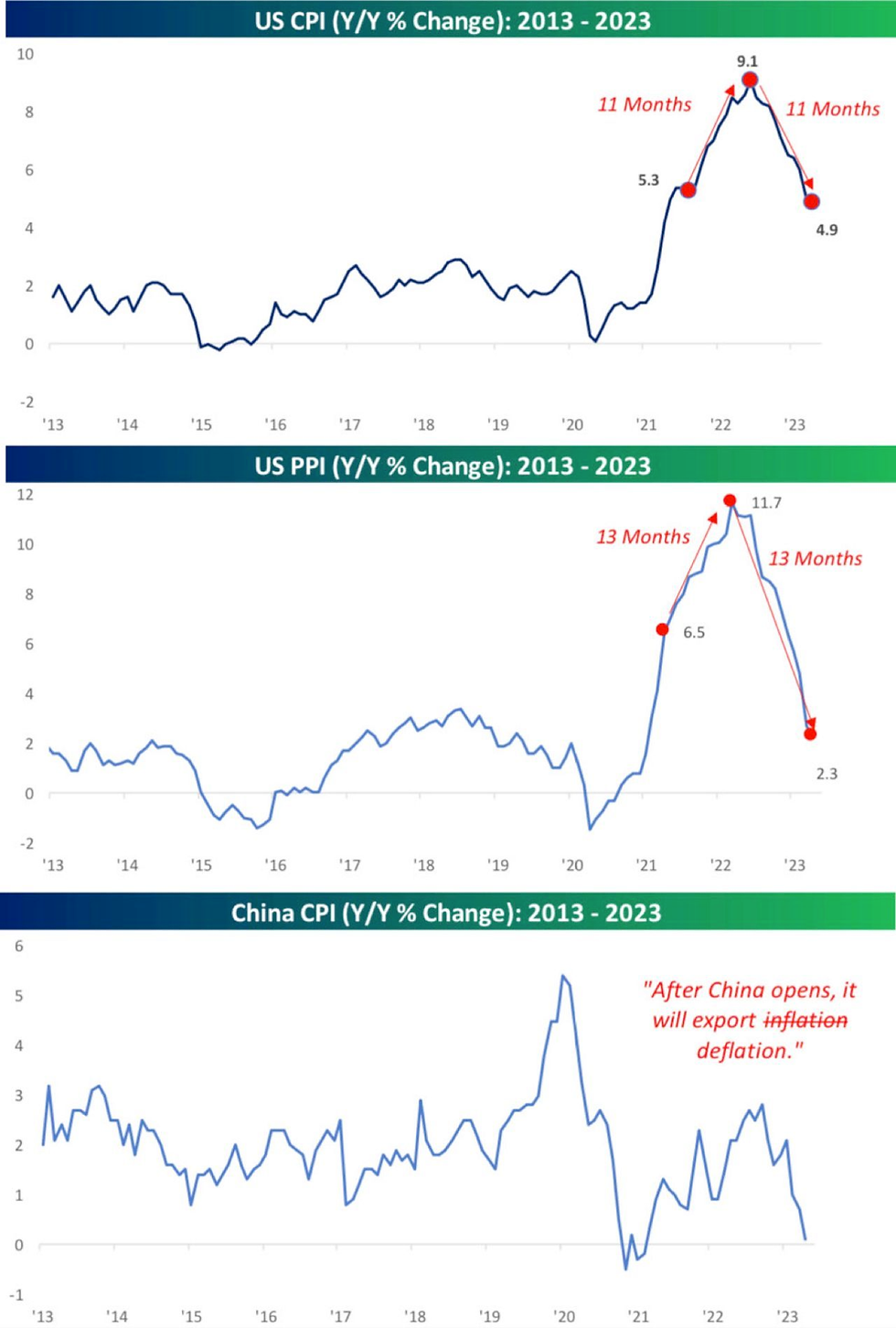

US CPI for the month of May will be published today. After one of the fastest interest #ratehikes in history, inflation is indeed receding, providing a victory lap feeling to a much criticized #federalreserve. As you can see in the chart below, inflation peaked on June 2022 at 9.1%, but over the last 11 months, it has gone down more rapidly than it grew in the 11 months preceding the peak, which shows prices deflating inertia. For today, consensus estimates a 4.1% YOY increase on CPI, still unacceptable for the fed, but half of what it was a year ago. And that doesn’t take into account the lagging effects of the #shelter component. The #fomc committee members, will end their meeting tomorrow with a decision on rates, and the futures market expects a pause with a 75% probability. We may be at a turning point in terms of US monetary policy.

Want to know more? join Fund@mental here https://apps.apple.com/us/app/fund-mental/id1495036084

Chart Source: Bespoke Investments group

Comments