CRE growing pains

- Gustavo A Cano, CFA, FRM

- Feb 12, 2024

- 1 min read

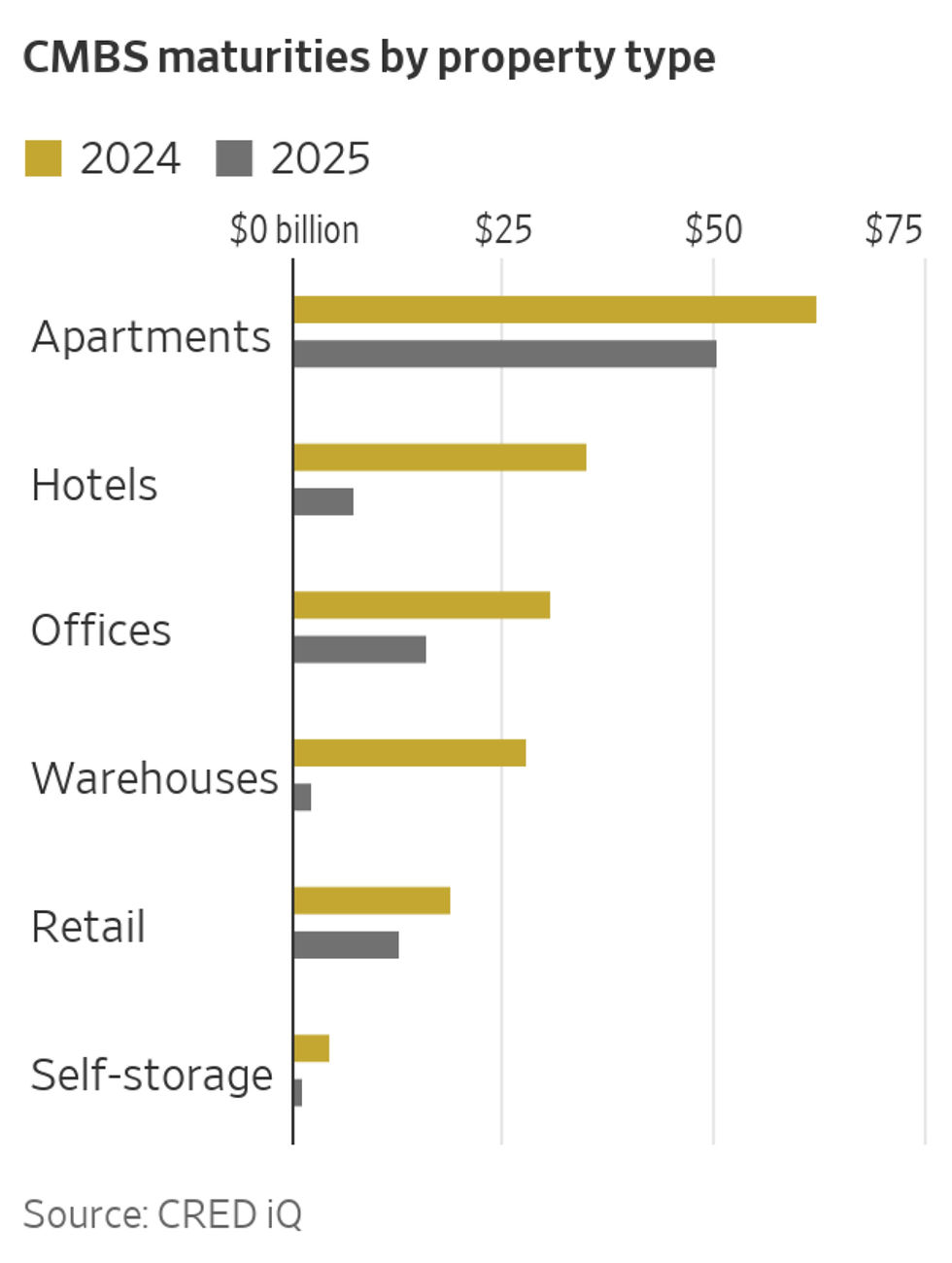

The squeeze on banks balance sheets continues. On the liability side, deposits demand high rates, with fierce competition from big banks, Money Market Funds and Treasury bills. On the asset side, the bond portfolio acquired during #zirp at very low coupons, is trading 15-20% below par. On top of that, the lending book is suffering from Commercial Real Estate, particularly the office market. Of the $36Bn of CMBS (a great proxy for banks commercial lending book) maturing in 2023, only 26% was paid off in full. The rest saw their maturities extended or were transferred to special servicers, where the terms are negotiated. Valuations of the office portion of those CMBS showed a 40% decline in price, which means banks will have to increase provisions for these doubtful loans. In top of that, about $40Bn in additional office CMBS will mature on 2024 and 2025.

Want to know more? join Fund@mental here https://apps.apple.com/us/app/fund-mental/id1495036084

#iamfundamental #soyfundamental #wealthmanagement #familyoffice #financialadvisor #financialplanning

Chart source: WSJ

Comentários