Cause effect relationships

- Gustavo A Cano, CFA, FRM

- Jul 28, 2024

- 2 min read

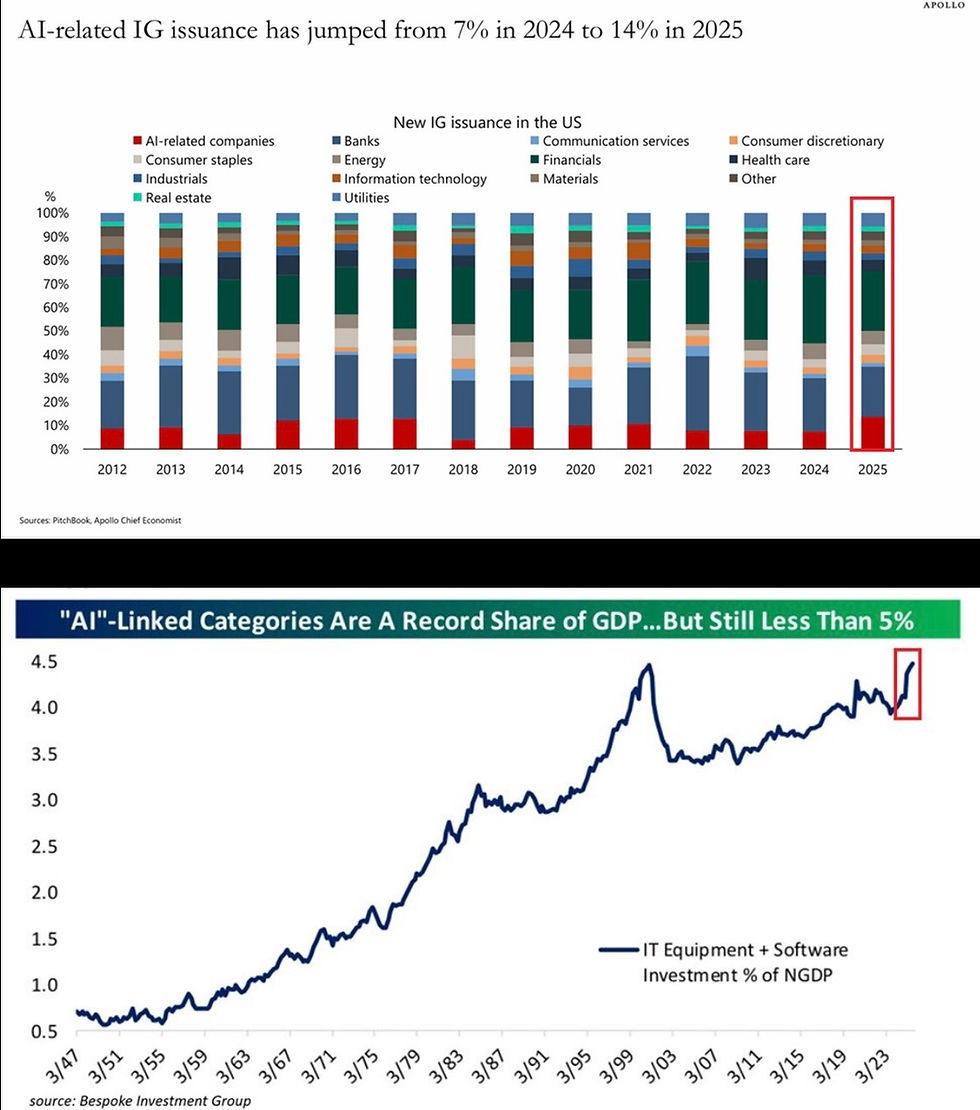

As we continue to monitor the different rotations in the equity market (also in credit), it’s important to analyze the cause-effect relationships underneath this bull market. Three main forces have pushed the markets, which in the end, have been transformed into a very powerful liquidity wave: (1) ZIRP and QE, (2) Buybacks and (3) Fiscal stimuli. After the GFC and for 10 years, the U.S. had zero interest rates and the Fed bought a significant amount of treasury bonds. That in turn, lowered the cost of money so much that big corporations issued massive amounts of cheap long term debt and used the proceeds to buy back enough of their outstanding shares, to create a shortage of paper vs liquidity that pushed stock prices up. Then Covid 19 came up and the US government sent checks to people who in turn saved it and invested it, jumping on the momentum wave, betting on the stocks that went up the most, the tech mega caps, which were the most aggressive with their respective balance sheets. Not even two years of rates at 5.25% have been able to stop this trend. As you can see in the chart below, the average fiscal deficit in the U.S. since the GFC has been 8.1% of GDP, dwarfing the rest of the developed world with the notable exception of Japan. What now? The Fed has reduced its balance sheet and hiked rates knowing the liquidity is still high enough, supported by the fiscal side without breaking anything. Can we lower the deficit and reduce debt relative to GDP? What happens if we do? How big buybacks need to be to offset the effects of restrictive fiscal policy? How low interest rates need to be? Will the Fed need to reinstate QE? What happens to inflation if they do?

Want to know more? join Fund@mental here https://apps.apple.com/us/app/fund-mental/id1495036084

#iamfundamental #soyfundamental #wealthmanagement #familyoffice #financialadvisor #financialplanning

Chart Source: Crescat capital

Comments